For Missouri Tax Exemption Purposes (DO NOT PUBLISH)

Dear Business Owner/Retailer,

Effective August 28, 2025, in accordance with Section 144.029, RSMo, the following items will be exempt from state and local sales and use tax when purchased in Missouri.

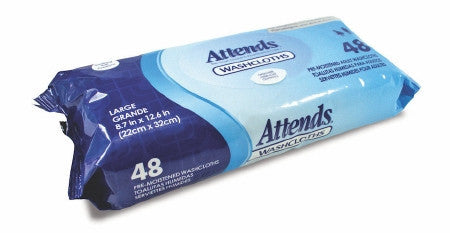

- Child and Adult Diapers

- Qualifying Feminine Hygiene Products

- Incontinence Products

According to the Department of Revenue's records, your business may be affected by this sales and use tax exemption. If you sell any of the qualifying items listed above, you must ensure that you are not charging tax on or after August 28, 2025.

Businesses that sell any of the qualifying items under this exemption will report the sales as a negative adjustment on their sales or use tax return and will no longer need to report these sales as part of their taxable sales.

Please review the Department’s FAQs page for guidance on which products qualify, as well as other common questions: dor.mo.gov/faq/taxation/

If you have questions not addressed in the FAQs, please contact the Sales and Use Tax Unit at salesuse@dor.mo.gov or 573-751-2836.

Sincerely,

TAXATION DIVISION